Are you concerned about rising property taxes? Do you believe in fiscal responsibility and transparency? If so, you need to be at the Menands Village Board Meeting on Monday, March 3rd, 2025, at 6 P.M.

Why Is This Meeting Crucial?

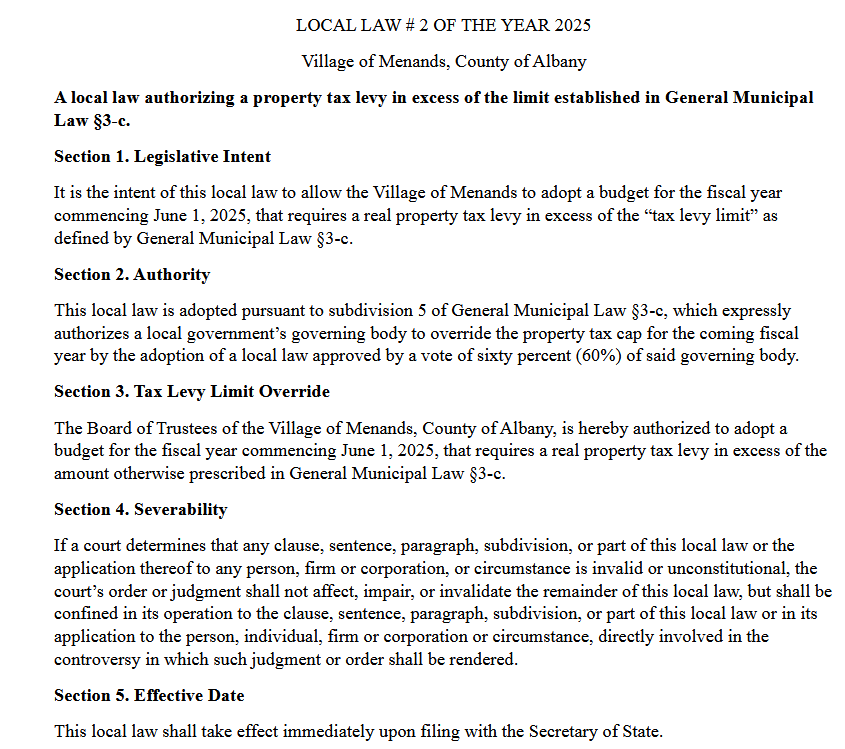

Local Law #2 of 2025—the focus of this meeting—would allow the Village of Menands to override New York State’s property tax cap (General Municipal Law §3-c). In other words, the Board could bypass the usual taxpayer protections and potentially raise property taxes above state limits without having presented a detailed budget.

“This law is designed to protect taxpayers from excessive tax increases.”

(NYS Division of the Budget, 2011)

However, the Village claims it’s dissolving the Village Court, which would save over $200,000 annually, yet there is no formal budget explaining why those savings aren’t enough to remain under the tax cap.

Meeting Details

- Date & Time: Monday, March 3, 2025, at 6 P.M.

- Location: Second Floor, 250 Broadway, Menands, NY

- Virtual Access:

- Google Meet: meet.google.com/mre-txbp-btk

- Phone: +1 (401) 646-0768, PIN: 541 841 494#

- Public & Accessible: The meeting is open to everyone and handicap accessible.

- Submit Comments: Can’t attend? Send written comments by noon on March 3rd to Clerk Don Handerhan at dhanderhan@menandsny.gov.

Key Reasons to Oppose Local Law #2

Circumventing the Tax Cap

- New York’s property tax cap exists to protect taxpayers from sudden, large increases (Comptroller, 2022). Overriding it before presenting a budget undermines its purpose.

Lack of Transparency

- The Board is seeking this override without a detailed budget in place. Residents deserve to see clear spending plans and specific justifications for exceeding the cap.

Potential for Unnecessary Tax Increases

- With $200,000 in savings from dissolving the Village Court, the Village should be able to stay within or near the cap. Why push for an override if significant cuts have already been made?

Fiscal Responsibility

- Overriding the tax cap should be a last resort, not a preemptive measure. Ask your representatives to explore alternative solutions or present a comprehensive budget first.

How You Can Take Action

Attend the Meeting

- Show up in person or join the Google Meet to stay informed and ask direct questions about budget allocations, spending priorities, and the rationale for overriding the tax cap.

Submit Written Comments

- If you can’t attend, voice your concerns by emailing dhanderhan@menandsny.gov before noon on March 3rd. Every comment matters.

Share the Information

- Spread the word on social media, in local forums, or with friends and neighbors. The stronger our collective voice, the more seriously the Board must consider community input.

Ask Direct Questions

- Why is the override necessary if the Village Court dissolution is saving so much money?

- What specific tax increase is being considered?

- Why wasn’t a comprehensive budget presented first?

- What alternative revenue or cost-saving measures could be used?

Make Your Voice Heard

Local government works best when community members are informed and engaged. This is your opportunity to protect your hard-earned money and uphold the intent of state law designed to shield residents from excessive tax increases.

Mark your calendar, and join your neighbors in standing up for fiscal responsibility and transparent governance in Menands.

Your presence—or your written comments—can make a difference!

References

- New York State Division of the Budget. (2011). The property tax cap. [Budget Archives]. https://www.budget.ny.gov/pubs/archive/fy1112archive/eBudget1112/fy1112initBudget.html

- Office of the New York State Comptroller. (2022). Real Property Tax Cap. https://www.osc.state.ny.us/localgov/realprop/index.htmKeywords:

Menands Village Board Meeting, Local Law #2 of 2025, property tax cap, fiscal responsibility, tax levy limit, budget transparency, community engagement, taxpayer protection, Village Court dissolution, rising property taxes.